Irr Sensitivity Analysis

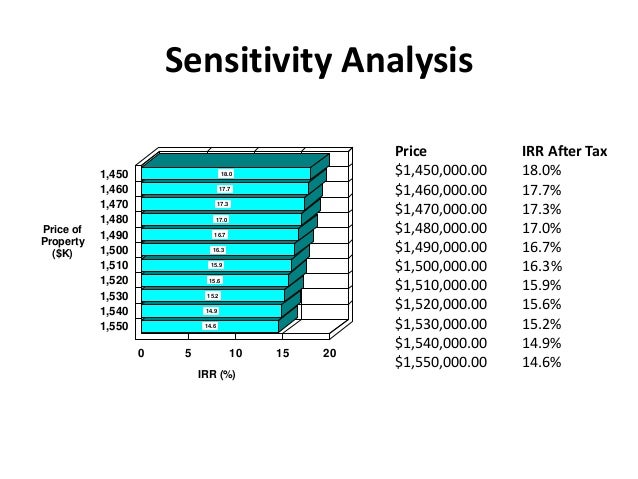

Developed for the commercial investment real estate professional, enables financial analysis of income producing properties and cost comparison analysis.

This post continues a discussion about cash flow, net present value, interest rates and NPV, and IRR, which you can read by clicking on the specific links. This post

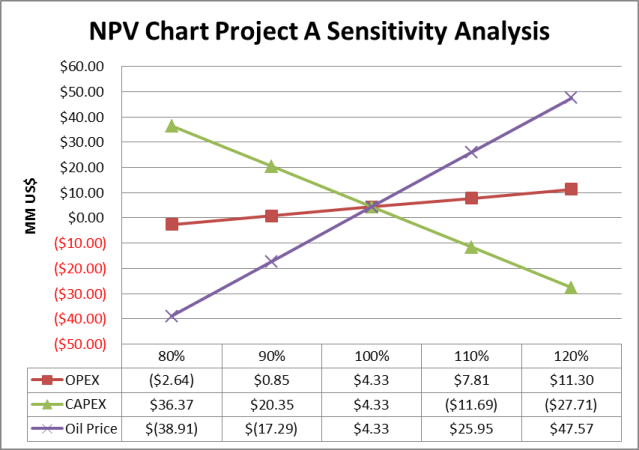

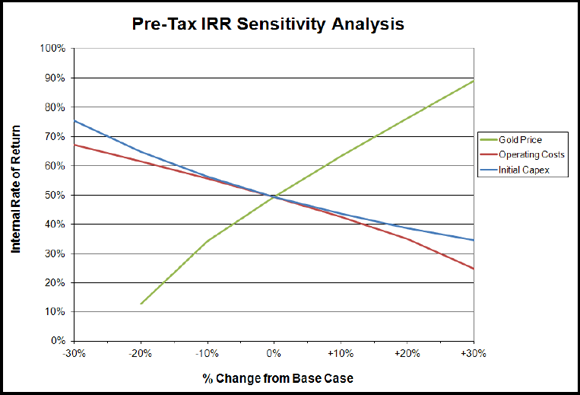

Net present value is an absolute measure i.e. it represents the dollar amount of value added or lost by undertaking a project. IRR on the other hand is a relative

Internal Rate of Return (“IRR”) The IRR of an investment is the discount rate that makes the net present value (“NPV”) of the investment’s cash flow stream equal to zero.

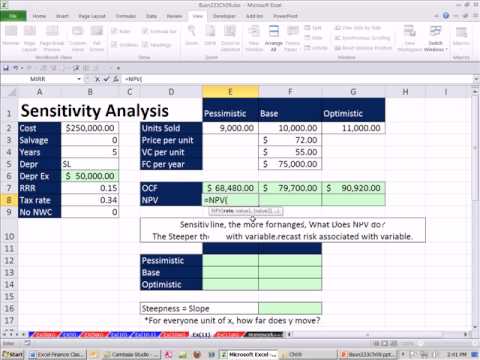

Sensitivity Analysis in Excel Template Example Using Two Variables, Data Table, Goal Seek Solver, What If Analysis for DCF : Financial Model Template

Sensitivity Analysis Using Excel 2 The main goal of sensitivity analysis is to gain insight into which assumptions are critical, i.e., which assumptions affect choice.

SENSITIVITY TO MARKET RISK Section 7.1 RMS Manual of Examination Policies 7.1-1 Sensitivity to Market Risk (3/15) Federal Deposit Insurance Corporation

Capital budgeting techniques: Sensitivity and Scenario analysis. Published: 3rd October, 2016 Last Edited: 17th October, 2016. This essay has been submitted by a student.

Importantly, effective IRR management not only involves the identification and measurement of IRR, but also provides for appropriate actions to control this risk.

A sensitivity analysis consists of three main components namely; 1) The Heading, 2) Sales Percentage Factors, and 3) The Body. Below briefly explains each component